Are you tired of watching your savings account remain stagnant while financial stress continues to grow? You’re not alone. With rising costs and inflation putting pressure on our wallets, finding effective ways to save money has become more challenging than ever. The 52 Week Savings Challenge offers a practical solution that has helped thousands transform their financial habits without feeling overwhelmed.

This step-by-step money-saving strategy breaks down your yearly savings goal into manageable weekly deposits, starting with just $1 in your first week! What makes this approach particularly effective is how it builds momentum gradually, allowing your savings muscles to strengthen over time.

Whether you’re saving for an emergency fund, a dream vacation, or just trying to establish better financial habits, this challenge provides the structure and motivation you need to succeed.

What is the 52 Week Savings Challenge?

The 52 Week Savings Challenge represents a systematic approach to building your savings progressively throughout the year. This popular money-saving method transforms the daunting task of saving into a manageable weekly habit that grows gradually. Starting with just a small commitment, you’ll develop financial discipline that compounds into significant results by year’s end!

How the 52 Week Money Challenge Works

You’ve probably heard about saving money before, but actually doing it consistently is where most of us stumble. I know I did for years until I found the 52 week savings challenge. This one-year savings plan transformed how I thought about putting money aside, making it feel less like a chore and more like a game I could win.

1. The Traditional Method

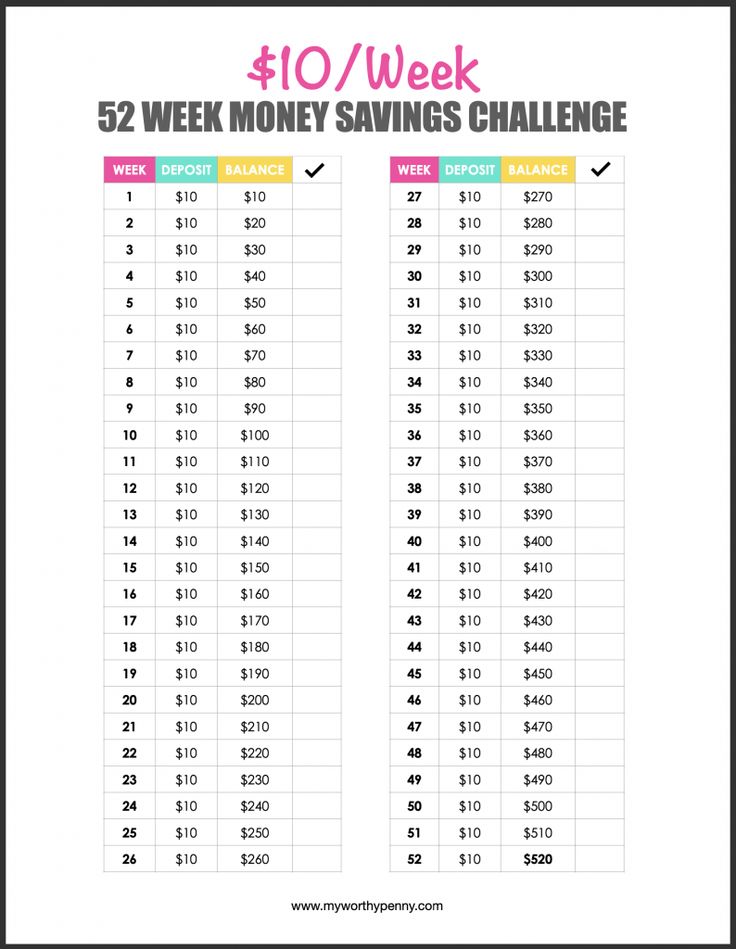

The traditional 52 week savings challenge is beautifully simple, which is exactly why it works so well. You start by saving just $10 in Week 1 of your challenge.

Each subsequent week, you increase your savings amount by $10 (Week 2 = $20, Week 3 = $30). The beauty of this approach is how gradually it scales up. During those first few weeks, you’re barely noticing the money leaving your wallet, but you’re building that savings muscle.

By Week 52, you’ll be saving $520 in your final week. Yeah, that last month gets a bit tougher – December had me scraping together those final deposits while also buying holiday gifts – but by then, you’ve built up so much progress that stopping feels harder than continuing.

What’s really cool is the total saved equals $13,780 by completing the full-year challenge. Not bad for something that started with just a single dollar, and could still be taken a bit further in the amount you choose to start with.

2. Reverse Method

Now, let’s talk about flipping the script. Some people prefer the reverse approach to the 52 week savings challenge.

With this variation, you begin with the largest amount of $520 in Week 1. Then you decrease your weekly contribution by $10 each week until you end with just $10 in Week 52.

This method is perfect for those who want to tackle the hardest part first or align with year-end expenses.

The reverse method of this one-year savings plan yields exactly the same total – $13,780 – but the psychological effect is totally different. It’s like running downhill instead of up; each week gets easier instead of harder.

I’ve got to admit, there’s something really satisfying about watching those required contributions shrink every week. It’s like a little reward for sticking with your savings plan.

Whichever method you choose for your 52 week savings challenge, the important thing is picking the approach that matches your personality and cash flow. Some weeks you’ll nail it, other weeks you might struggle a bit – that’s normal and happens to everyone trying to build new money habits.

Benefits of the 52 Week Savings Challenge

I never thought I’d be the type of person who gets excited about saving money. For years, I’d try to put money aside only to raid my savings account a few weeks later for something I “absolutely needed.” But when I finally commit to the 52 week savings challenge, something clicked. This one-year savings plan did more than just help me save money—it changed my entire relationship with my finances.

Money Saving Challenge Mental Benefits

The 52 week savings challenge creates a sustainable savings habit through incremental progress. Unlike those hardcore budgeting systems that had me feeling deprived after just a few days, this challenge eases you gently. You also get this immediate sense of achievement with each weekly deposit.

What’s really clever about the 52 week savings challenge is how it transforms saving from a chore into a game with clear milestones. Some weeks I’d find myself scrounging for change in my car just to make my deposit, laughing at how determined I’d become not to break my streak.

Another benefit I didn’t expect was how it reduces financial anxiety by providing structure to your savings plan. Before the challenge, thinking about money always made my stomach knot up. But having this simple, doable system in place helped me sleep better at night, knowing I was finally building that financial cushion everyone’s always talking about.

Financial Impact

The most obvious benefit is how this one-year savings plan builds a substantial emergency fund of $13,780+ in just one year. That might not sound like a life-changing amount at first, but let me tell you about the time my car broke down six months into the challenge. Instead of panicking or putting the repair on my already maxed-out credit card, I had options. That feeling alone was worth every penny I’d saved.

This challenge teaches disciplined money management that extends beyond the challenge itself. After completing my first 52 week savings challenge, I found myself applying the same thinking to other areas—questioning impulse purchases and looking for creative ways to stretch my dollars.

It also provides a foundation for more advanced saving strategies. Once you’ve got the habit to prove that you can successfully complete this challenge, suddenly those other financial goals like saving for a down payment or boosting your retirement contributions will seem a lot more achievable.

Creative Variations of the 52 Week Savings Challenge

At first, I thought there was just one way to perform the challenge. Not until after talking with friends and reading up online, I discovered there are tons of ways to customize this one-year savings plan. That’s when it really clicked for me—this challenge isn’t a rigid system; it’s more like a template you can remix to fit your life.

1. Personalized Money Saving Challenge Strategies

One of my favorite variations is the random method by shuffling amounts and picking weekly contributions randomly. One thing to note about this approach is that it is inconsistent in terms of knowing the actual amount to save.

You might prefer the constant amount method by saving a fixed $26.50 weekly. My sister goes this route because she likes the predictability. “Same amount, same day, every week—no thinking required,” she always says. And she’s right—by the end of the 52 week savings challenge, she’s got the same $13,780 as someone doing the traditional method, but without the stress of increasing amounts.

If you get paid bi-weekly like I used to, you might want to experiment with a bi-weekly approach for those paid every two weeks. Instead of 52 small deposits, you make 26 larger ones that align with your paychecks. This worked great for a couple of years when I had that office job with regular pay periods.

The beauty of this one-year savings plan is that you can design a personalized challenge based on your specific income pattern and goals.

2. Digital Enhancements

Technology has made the 52 week savings challenge even easier to stick with. You can explore automated saving apps that handle transfers for you.

Many apps also offer savings trackers to visualize your progress. There’s something weirdly motivating about watching that little digital thermometer rise throughout the year. My favorite app sends me achievement badges for milestone weeks, which sounds silly but actually keeps me going.

Something that really helped me stay committed was joining online communities for accountability and motivation. When I was tempted to skip a week, seeing others post about completing their deposits would guilt me (in a good way!) into making mine too. Plus, people share some really clever money-saving hacks in those groups.

Another cool option is using round-up tools that complement your weekly savings. These round up your purchases to the nearest dollar and set aside the difference. It doesn’t replace your weekly 52 week savings challenge contribution, but it creates a nice little bonus fund alongside it.

I’ve learned that the best version of the challenge is the one you’ll complete. Whether that’s the traditional method, reverse approach, or some wild variation you invented yourself—if it helps you save consistently, it’s the right one for you.

How to Successfully Complete the Challenge

The 52 week savings challenge looks simple on paper, but completing the entire one-year savings plan takes more than just good intentions. I’ve started this challenge three times before finally making it all the way through. What made the difference? A few practical strategies that turned this savings challenge from an ambitious goal into an achievable reality.

When I finally completed the 52 week savings challenge, these were the key difference makers that made it possible:

1. Money saving challenge: Automate your savings

Through scheduled bank transfers this was honestly my secret weapon. Keep your challenge money in a separate high-yield savings account. During my first attempt at this one-year savings plan, I kept everything in my checking account. Big mistake! The money didn’t feel “special,” and I constantly dipped into it. Opening a dedicated account preferably one that pays decent interest and isn’t linked to my debit card—made a world of difference.

Celebrate milestone weeks (13, 26, 39, 52) to maintain motivation. Saving money for an entire year can feel like a marathon, so I learned to create mini-celebrations at the quarter marks. Nothing expensive—maybe a movie night or a favorite home-cooked meal but acknowledging these milestones kept my enthusiasm up when the novelty of the challenge started to wear off.

2. Overcoming Common Obstacles

Let’s be real—over 52 weeks, life will throw curveballs at your savings plan. Here’s how to handle them:

Develop strategies for handling difficult weeks when saving gets challenging. There were weeks (particularly around weeks 40-50 of the traditional method) when the required amounts felt impossible. What I’d do is Keep a “buffer fund” on the side by occasionally saving a few dollars extra during easier weeks. This buffer became my safety net during tight times.

Understand how to catch up if you miss a week without abandoning the challenge. Missing a week happens to almost everyone attempting this one-year savings plan. The key is not letting one missed week turn into abandoning the entire challenge.

If you miss a week, don’t try to double up the next week (that’s often too difficult). Instead, make up the missed amount gradually over several weeks.

Identify ways to find extra money for higher-amount weeks. During those challenging later weeks (if you’re doing the traditional approach), I found success in temporarily suspending small luxuries—making coffee at home instead of buying it, having a potluck instead of eating out, or selling items I no longer needed. These small actions freed up cash for those bigger weekly deposits.

The 52 week savings challenge isn’t meant to make you miserable—it’s meant to build a sustainable savings habit. If you need to modify it to fit your life better, that’s not cheating, that’s being smart about your personal finance journey.

How To Get Started Today

I could recall staring at my empty savings account and thinking, “I’ll start saving next month when things are less crazy.” Spoiler alert: things never got less crazy, and my savings never grew—until I finally stopped waiting for the “perfect time” to begin the 52 week savings challenge. The truth is, the best time to start your one-year savings plan is right now, today, regardless of what day or month it is.

Setting Up Your Challenge

The first step is choosing the right savings account for housing your challenge money. Open a separate account—preferably one that pays interest—so your challenge money isn’t constantly tempting you every time you check your balance.

Next, create a tracking system that works for your lifestyle. Some people love physical trackers they can hang on the wall, while others prefer digital apps or spreadsheets. I’ve tried them all, and the best tracking system isn’t the fanciest one—it’s the one you’ll use consistently throughout your one-year savings plan.

You’ll also need to decide which variation of the challenge best fits your financial situation. Are you the type who wants to start small and build gradually (traditional approach)? Or would you rather tackle the biggest amounts when you’re fresh and motivated (reverse method)? Be honest with yourself about which approach matches your personality and cash flow patterns.

Determining your specific savings goal provides additional motivation beyond just completing the challenge. Sure, saving $13,780 is great, but saving $13,780 for something makes the challenge much more meaningful. My first successful 52 week savings challenge funded a weekend trip I’d been dreaming about for years. Having that concrete goal made a huge difference when temptation struck.

First Steps Checklist

Ready to start your one-year savings journey? Here’s exactly what to do:

1. Open a dedicated savings account

I’d recommend shopping around for a high-yield savings account that’ll pay you a bit of interest on your growing balance. Many online banks offer no-fee accounts perfect for this purpose. It took me all of 15 minutes to open mine, and that small time investment paid dividends throughout my savings journey.

2. Download a tracking template

There are tons of free printables online specifically designed for the 52 week savings challenge. Pick one that visually appeals to you, since you’ll be looking at it all year.

3. Schedule reminders

Whether it’s a recurring calendar alert, a note on your fridge, or an automatic notification from your banking app, make sure you’ve got something that’ll nudge you each week. The 52 week savings challenge depends on consistency, and our brains need these regular prompts, especially in the beginning before the habit is formed.

The 52 week savings challenge isn’t complicated, but that doesn’t mean it’s always easy. There will be weeks when finding that money feels impossible, and weeks when you forget to make your deposit altogether. That’s normal! What matters isn’t perfection but persistence. If you mess up (and most of us do at some point), just pick up where you left off and keep going.

A year from now, you’ll wish you had started today. So grab your dollar, open that savings account, and take the first step toward building your financial cushion. Future you is already grateful for the decision you’re about to make.

Conclusion

The 52 Week Savings Challenge offers more than just a way to save $13,780 in a year—it provides a framework for developing lifelong saving habits. By breaking down the seemingly impossible task of building an emergency fund into manageable weekly steps, this challenge makes financial security accessible to everyone, regardless of income level or previous saving experience.

Whether you choose the traditional approach, the reverse method, or a personalized variation, the key is consistency and commitment. Recall that even if you encounter obstacles along the way, every dollar saved represents progress toward your financial goals.

FAQ’s

Absolutely! While many people begin in January, you can start the 52 Week Savings Challenge any time. The important thing is to commit to the full 52 weeks, regardless of when you begin. Some people even prefer starting mid-year when their finances are more stable after tax season.

If the increasing amounts become difficult, consider trying the reverse method (starting with $520 and decreasing each week) or the random method (shuffling the amounts). Another option is to save a consistent $26.50 weekly, which will still result in the same total by year’s end.

Both approaches work! Some people prefer the visual motivation of cash in envelopes or a jar, while others benefit from the automation and interest-earning potential of digital savings accounts. Choose the method that aligns best with your habits and what will keep you most accountable.

To maximize long-term impact, pair the challenge with automatic transfers to a high-yield savings account, track your progress visually, celebrate milestones, and plan to immediately start a new challenge or saving goal once you complete the 52 weeks.