Creating a budget is often seen as restrictive, but it’s one of the most effective financial tools at your disposal. Without a clear plan, it’s easy to overspend and struggle to meet financial goals. When you create a budget, you gain better control over your income, ensuring that essential expenses, savings, and even entertainment are accounted for!

According to a 2024 survey by the Financial Health Network, individuals who maintain a consistent budget are 3.5 times more likely to achieve their financial goals than those who don’t. Even If you’re struggling with debt, saving for a major purchase, or simply want better control over your finances, a well-crafted budget serves as your roadmap to financial success.

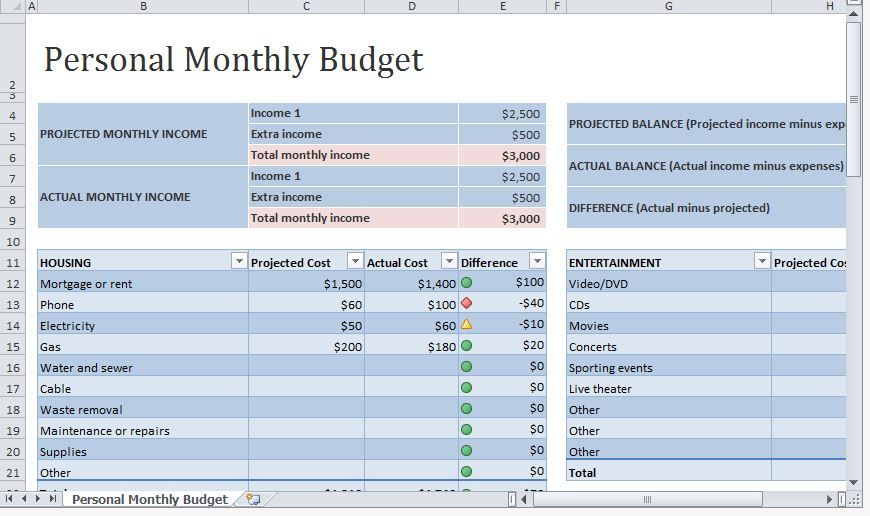

The good news? Creating an effective budget doesn’t require complex spreadsheets or financial expertise – just a willingness to be honest about your spending habits and financial priorities.

How to Create a Budget That Works

Understanding your financial situation is the first step toward stability. By following a structured approach, you can develop a budgeting system that helps manage daily expenses while supporting long-term goals. To stay in control of your money, you must create a budget that aligns with both your needs and future aspirations.

With that said, let’s dive deeper into the seven steps that can actually create a solid-proof budget for you.

Step 1: Gathering Your Financial Information for Financial Goals

I’ve been in situations where bank statements were scattered everywhere, receipts crumpled in random drawers, and absolutely zero clue about where my money was actually going. Sound familiar?

Collecting Your Financial Puzzle Pieces

Create a budget that isn’t about punishment—it’s about understanding your financial situation. That starts with gathering every single piece of financial documentation you can find. Think of it like detective work—you’re investigating the mystery of your own money trail.

Here’s what you’ll want to hunt down:

- Income Documentation: This isn’t just your main paycheck. We’re talking everything. Freelance gigs, that side hustle selling handmade candles, rental income, birthday checks from grandma – all of it matters. Pull together pay stubs, invoices, and any proof of money coming in.

- Expense Statements: Dig out those bills and statements from the past 3-6 months. Credit card statements, utility bills, subscription receipts – nothing gets left behind. This isn’t just about knowing what you owe but understanding your spending patterns.

- Transaction Histories: Most banks let you download transaction histories. Do it. This gives you the nitty-gritty details of where every single dollar has been spent. Those $5 coffee runs? They add up faster than you’d believe.

Pro Tips: Here’s a hack I learned through trial and error: create a dedicated folder – digital or physical – just for these financial documents. Mine’s a bright orange folder that screams “IMPORTANT MONEY STUFF” so I never accidentally toss it out.

Breaking Down the Budgeting Process

Don’t get overwhelmed if this seems like a lot. Break it down into bite-sized tasks. Maybe spend 30 minutes one evening gathering bank statements. Another evening, tackle credit card histories. Small, consistent steps beat total financial paralysis every single time.

Gathering your financial info isn’t just bureaucratic nonsense. It’s your financial self-portrait. These documents tell a story about your spending habits, income streams, and potential areas for improvement. By getting everything in one place, you’re setting yourself up for budget success.

Remember, a budget isn’t a straitjacket. It’s a roadmap to financial freedom. And every great journey starts with knowing exactly where you’re beginning.

Step 2: Calculate Your Total Monthly Income to Create a Budget

Knowing how to create a budget isn’t just about cutting expenses—it’s about understanding the intricate ecosystem of your earnings. Many people stumble at the first hurdle: accurately calculating their total monthly income. This isn’t just number-crunching; it’s financial self-discovery.

The Multifaceted Nature of Modern Income and Financial Goals

In today’s economic scenery, income has transformed from a simple paycheck to a complex web of earnings. The traditional 9-to-5 job is no longer the sole financial lifeline. Freelance gigs, digital side hustles, passive income streams, and seasonal earnings have revolutionized how we think about money.

Let’s break down the Income streams for effective budget planning.

When creating a budget, precision is your greatest ally. Here’s a systematic approach to income calculation that goes beyond surface-level numbers:

- Primary Employment Income Tracking your core income isn’t just about your gross salary. Focus on net income—the actual money landing in your account after taxes and deductions. This realistic figure becomes the cornerstone of your budget framework.

- Variable and Supplemental Earnings Seasonal workers, commission-based professionals, and side hustle entrepreneurs face unique challenges. The key is developing a conservative estimation method:

- Average your earnings over 6-12 months

- Identify consistent income patterns

- Separate reliable from unpredictable earnings

The Risk of Income Miscalculation

Overestimating income is a budget killer. One miscalculated dollar can throw your entire financial planning off balance. That’s why it’s important to create a budget that accounts for realistic earnings. Think of your budget like a precision instrument—each component must be meticulously calibrated.

The art of creating a budget intersects deeply with income understanding. It’s not just about tracking money—it’s about mapping your financial ecosystem, understanding earning potential, and creating strategic financial boundaries.

Budget creation is as much a mental exercise as a mathematical one. By understanding your income streams, you’re not just managing money—you’re crafting a narrative of financial empowerment.

Create a budget with radical income transparency. Each dollar tracked is a step toward financial clarity. Your income isn’t just a number—it’s a story of potential, strategy, and personal economic sovereignty.

Step 3: Track and Categorize Your Expenses to Create a Budget

Expense tracking isn’t just about numbers—it’s about deciphering the narrative of your financial journey. Most people see expenses as simple debits and credits, but they’re actually intricate threads weaving together your lifestyle, priorities, and financial health.

The Anatomy of Expense Categories in Financial Goals

When creating a budget, understanding the depth of your expenses becomes unavoidable. Let’s break down the nuanced world of spending into several critical dimensions that go far beyond simple categorization.

1. Fixed Expenses: The Financial Backbone

Fixed expenses are the structural pillars of your financial house. These are the predictable, consistent costs that form the foundation of your monthly spending. Think of them like the load-bearing walls of a house—they remain constant regardless of your monthly fluctuations. Rent or mortgage payments, insurance premiums, car loans, and consistent subscription services fall into this category.

The beauty of fixed expenses lies in their predictability. They provide a stable baseline when you create a budget, allowing you to understand exactly how much money is committed before discretionary spending even begins. However, don’t be fooled into thinking they’re entirely immutable. Regular reviews can often reveal opportunities for optimization—negotiating better insurance rates, refinancing loans, or finding more cost-effective subscription alternatives.

2. Variable Expenses: The Financial Chameleons

Variable expenses are the shape-shifters of your budget. Unlike their fixed counterparts, these costs dance to an unpredictable rhythm. Groceries, dining out, entertainment, shopping, and utility bills that fluctuate with seasonal changes all belong to this category.

Understanding variable expenses requires a detective’s mindset. When you create a budget, you’ll need to track patterns, identify triggers, and recognize the subtle influences that cause spending to spike or dip. Are your grocery bills higher during certain months? Do you tend to spend more on entertainment during specific seasons? These nuanced insights transform expense tracking from a mundane task to a fascinating exploration of your financial behaviors.

3. Discretionary vs. Necessary Spending

Think of your expenses as an ecosystem with different species of spending. Necessary expenses are the primary producers—they sustain your basic life systems. Rent, basic food, essential utilities, and healthcare form this critical foundation.

Discretionary expenses are like the exotic species in this ecosystem. They’re not essential for survival but add color, excitement, and personal flavor to your financial landscape. Streaming services, occasional dining out, hobby supplies, and impulse purchases fall here. While they’re not critical, they contribute significantly to your quality of life

Expense tracking transcends mere number-crunching. It’s a profound psychological journey of understanding your relationship with money. Each transaction is a decision, a small vote cast for the life you’re choosing to live.

Some expenses reveal deeper emotional patterns such as:

- Stress-induced shopping

- Comfort spending

- Social comparison through purchasing

- Aspirational buying

The Breakthrough Moment in Financial Goals

When you truly illuminate the landscape of your spending, you unlock unprecedented financial clarity. Expense tracking is less about cutting costs and more about aligning your money with your most authentic life goals.

Creating a budget becomes an act of self-discovery, a journey of understanding the intricate dance between your resources and your aspirations.

Step 4: Set Specific Financial Goals

Financial goals are more than just numbers on a spreadsheet. They’re the compass that guides your entire financial journey, transforming how you create a budget from a restrictive financial process into a dynamic roadmap of personal potential. Imagine your financial goals as a series of interconnected bridges, each spanning from your current reality to your most cherished dreams.

The Approach to Creating a Budget

Financial goal setting isn’t a one-size-fits-all strategy. It’s a nuanced art of aligning your immediate actions with your long-term vision. We’ll explore a multidimensional framework that breaks goals into intricate layers of complexity and impact.

1. Short-Term Goals: The Immediate Horizon

Short-term financial goals are the immediate waypoints in your financial expedition. These are typically achievable within one year and serve as critical momentum builders. Consider goals like:

- Creating an initial emergency fund of $1,000

- Paying off a specific small debt

- Reducing discretionary spending by 15%

- Saving for a targeted personal development course

These goals are your financial spark plugs—small, achievable targets that generate confidence and build momentum. They’re the psychological fuel that transforms how you create a budget from a theoretical exercise to a tangible, exciting journey.

2. Medium-Term Goals: The Strategic Landscape

Medium-term goals occupy the space between immediate gratification and long-range vision. Typically spanning 1-5 years, these goals require more sophisticated planning and consistent execution. Examples include:

- Saving for a substantial down payment on a home

- Building an emergency fund covering 3-6 months of expenses

- Investing in professional skill development

- Eliminating significant consumer debt

These goals demand a more strategic approach. They require you to balance immediate needs with future aspirations, creating a financial strategy that’s both flexible and disciplined.

3. Long-Term Goals: The Expansive Vision

Long-term goals are the grand architectural designs of your financial life. Spanning 5-30 years, these objectives require patience, consistent strategy, and a holistic view of your financial ecosystem. Think:

- Retirement planning

- Children’s education funding

- Generating passive income streams

- Creating generational wealth

These goals transcend simple financial accumulation. They represent your most profound financial commitments, reflecting your deepest values and most expansive life vision.

The SMART Framework: Transforming Dreams into Actionable Strategies

SMART goal setting isn’t just an acronym—it’s a sophisticated methodology for translating abstract desires into concrete financial strategies:

Specific: Eliminate vague intentions. Replace “I want to save money” with “I will save $5,000 for an emergency fund by December 31st.”

Measurable: Attach clear, quantifiable metrics to your goals. Tracking becomes your financial GPS, providing real-time feedback on your progress.

Achievable: Goals should stretch your capabilities without breaking your spirit. They’re challenging yet realistic, creating a balance between aspiration and practical execution.

Relevant: Each goal must align with your broader life vision. A goal disconnected from your core values is a goal destined to fail.

Time-Bound: Every goal needs a deadline. Time constraints transform wishes into commitments, creating a sense of urgency and focus.

The Architecture of Goal Setting

Financial goals are more than mathematical calculations. They’re profound psychological contracts with yourself. Each goal represents a declaration of personal agency, a statement that says, “I am the architect of my financial destiny.”

Creating a budget isn’t about restriction—it’s about strategic empowerment. Your financial goals should:

- Reflect on your most authentic life vision

- Balance immediate needs with future aspirations

- Provide flexibility for unexpected life changes

- Inspire continuous personal growth

When you approach budget creation as a goal-setting exercise, you transcend traditional financial management. You become a financial artist, carefully sculpting your resources to create a masterpiece of personal potential. Every number becomes a brushstroke, every goal a vibrant color on the canvas of your financial future.

Step 5: Create Your Budget Framework

Just as an architect carefully designs a building to withstand various environmental challenges, your budget framework must be robust, flexible, and precisely calibrated to support your financial ecosystem.

Understanding Budget Methodology: More Than Just Numbers

Budget frameworks are not one-size-fits-all solutions. They’re intricate systems that reflect individual financial landscapes, personal goals, and unique lifestyle dynamics.

Let’s explore the most powerful methodologies that transform budget creation from a mundane task to a strategic financial art form.

The Primary Budget Methodologies

1. 50/30/20 Rule: The Classical Approach Think of this method as the classical music of budgeting—a time-tested, harmonious approach to financial allocation. Here’s how the composition plays out:

- 50% of income dedicated to essential needs

- 30% allocated to personal wants and discretionary spending

- 20% directed towards savings and debt reduction

This methodology provides a balanced, intuitive framework that works for many individuals. However, it’s not a rigid prescription but a flexible guideline that can be adjusted based on personal financial contexts.

2. Zero-Based Budgeting: The Precision Instrument Zero-based budgeting is like a precise scientific instrument. Every single dollar is assigned a specific purpose, leaving no financial space unexplored. The goal is simple yet profound: ensure your income minus expenses equals zero, with each dollar strategically deployed.

This method demands meticulous attention but offers unparalleled financial visibility. It transforms budgeting from a passive recording of expenses to an active, intentional financial strategy.

3. Envelope System: The Tangible Budgeting Approach Rooted in a pre-digital era, the envelope system provides a tactile, visceral budgeting experience. Imagine physically distributing cash into different envelopes representing various expense categories. While digital tools have evolved, the core principle remains powerful: create clear, physical boundaries for different types of spending.

Budget frameworks transcend mathematical calculations. They’re profound expressions of personal values, priorities, and financial philosophy.

Each allocation is a strategic decision, a small vote cast for the life you’re choosing to create.

Transformation Through Strategic Budgeting

Creating a budget framework is an act of financial self-discovery. It’s about understanding the intricate dance between resources, aspirations, and practical constraints.

When you approach budget framework design as a holistic, strategic process, you transform from a passive financial participant to an active architect of your financial destiny.

Step 6: Creating a Budget That Works: The Implementation Masterclass

Create a budget that aligns with your lifestyle, but remember, execution is key. Implementing your budget system turns financial planning from theory into a functional, adaptable strategy that drives real results.

Selecting Your Budget Implementation Tools

When creating a budget, the right tools become your financial navigation system. Modern budgeting isn’t about restriction—it’s about creating a seamless, intuitive financial management experience.

Digital Budget Tracking Platforms: Creating a budget using digital leveraging means the application of technology to transform financial tracking from a chore to an engaging experience. Consider tools that offer:

- Automatic transaction categorization

- Real-time spending alerts

- Customizable budget creation features

- Visual spending dashboards

The key to successful budget implementation lies in finding a system that feels natural to your personal financial style. Some individuals thrive with complex spreadsheets, while others prefer minimalist mobile apps.

The Psychology of Budget Implementation

Financial management requires more than just number crunching—it demands a deep understanding of both spending habits and emotional triggers. This is why you must create a budget that integrates practical strategies with psychological awareness.

Successful budget creation requires built-in accountability:

- Weekly budget check-ins

- Shared financial tracking with a partner

- Regular financial goal reassessment

- Honest self-reflection about spending patterns

Overcoming Challenges to Create a Budget

Creating a budget is rarely a smooth, linear process. Expect challenges and build flexibility into your implementation strategy:

- Start with forgiving, broad categories

- Allow for monthly adjustments

- Celebrate small wins

- Approach setbacks as learning opportunities

When you approach budget creation as a dynamic, evolving process, you transform financial management from a dreaded task to an empowering journey of self-discovery. Every tracked expense becomes a stepping stone toward financial mastery.

Step 7: Monitor and Adjust Your Budget Regularly

Your budget can be like a living, breathing organism sometimes—constantly changing, adapting, and growing alongside your life’s unique journey. Creating a budget isn’t a one-time event but an ongoing dialogue with your financial potential, a dynamic process of continuous learning and strategic refinement.

The Rhythmic Approach to Financial Monitoring

The art of budget monitoring unfolds across multiple temporal dimensions, each offering unique insights into your financial ecosystem. These review cycles are not rigid checkpoints but fluid, interconnected moments of financial self-discovery, reinforcing the need to create a budget that adapts to your evolving financial landscape.

The Weekly Financial Pulse Check

Weekly reviews are like taking your financial temperature. These brief, 15-20 minutes sessions serve as early warning systems, allowing you to catch potential financial discrepancies before they become significant challenges. During these micro-reviews, you’ll scan recent transactions, identify immediate spending patterns, and maintain real-time financial awareness.

Think of this as a quick health check for your financial body—a moment to breathe, observe, and make minor adjustments. It’s less about detailed analysis and more about maintaining consistent financial mindfulness.

The Monthly Financial Deep Dive to Create a Budget

Monthly reviews transform into comprehensive financial explorations. This is where you become a financial detective, meticulously examining the intricate details of your spending journey. You’ll dissect expense categories, trace income patterns, assess goal progress, and strategically realign your budget framework.

These sessions are investigative journeys, revealing the subtle narratives hidden within your financial data. You’re not just looking at numbers—you’re uncovering the story of your financial choices, motivations, and potential, all of which emphasize the importance of taking the time to create a budget that aligns with your goals.

The Quarterly Strategic Reassessment

Quarterly reviews represent your financial panoramic view. Here, you step back and examine your broader financial terrain. Major life changes, significant income shifts, and long-term goal transformations become your primary focus.

This is where budget creation transcends mere number-tracking and becomes a profound act of strategic life design. You’re calibrating your financial compass, ensuring it points toward your most authentic aspirations.

The Dimensions of Monitoring Financial Goals

Budget monitoring is a deeply psychological practice. It demands a nuanced mindset that balances analytical precision with emotional intelligence:

- Approach your finances with curiosity, not judgment

- Embrace flexibility over rigid constraints

- Prioritize continuous learning over perfection

- View financial challenges as opportunities for growth

Creating a budget is ultimately an act of self-respect and intentional living. Each review and each adjustment becomes a brushstroke in the masterpiece of your financial potential. Your budget is more than a document—it’s a dynamic map charting the course of your most authentic life journey.

Conclusion

Creating a budget isn’t about restricting yourself – it’s about gaining control and directing your money toward what matters most to you. With these seven practical steps, you can develop a personalized budget that fits your lifestyle while helping you achieve your financial goals.

Bear in mind that, budgeting is a skill that improves with practice, so don’t be discouraged if your first attempts need adjustment. The most successful budgeters recognize that flexibility and consistency are key. Start small, be realistic about your habits, and focus on progress rather than perfection. With time and persistence, your budget will become second nature, empowering you to make confident financial decisions and build the future you want.

FAQ’s

Your budget categories should be specific enough to give you clear insights into your spending patterns but not so detailed that they become overwhelming to track. Most effective budgets include 10-15 main categories, with subcategories for areas where you want more detailed tracking.

The best budgeting app is the one you’ll actually use consistently. Popular options like Mint, YNAB (You Need A Budget), and Personal Capital offer different features that appeal to different budgeting styles.

For irregular expenses like annual insurance premiums, holiday gifts, or car repairs, create “sinking funds” within your budget. Calculate the annual cost of these expenses, divide by 12, and set aside that amount monthly in designated savings categories.

While percentages vary based on individual circumstances and priorities, the 50/30/20 rule offers a good starting point: 50% for needs (housing, food, utilities, transportation), 30% for wants (entertainment, dining out, hobbies), and 20% for savings and debt repayment.

Building an emergency fund should be a top priority in your budget to handle truly unexpected expenses. Aim to gradually build 3-6 months of essential expenses in an easily accessible savings account. For smaller unexpected costs, include a “miscellaneous” or “buffer” category in your monthly budget.