In Nigeria’s dynamic economy, the boldest entrepreneurs are increasingly looking beyond traditional investment vehicles to accelerate their growth. While conventional wisdom often steers small businesses toward safe, modest-return investments, a growing number of forward-thinking Nigerian business owners are strategically allocating portions of their capital to high risk investments, seeking higher returns despite potential volatility.

With Nigeria’s GDP growth projected to exceed 3.3% in 2025 despite global economic headwinds, the potential for extraordinary returns exists for those willing to embrace calculated risk.

This article examines the seven most promising high risk investments specifically suited for small businesses seeking for funds and operating within Nigeria’s unique economic environment. From cutting-edge digital assets to tangible business ventures, these options offer pathways to exponential growth—when approached with the right strategy and risk management framework.

Whether you’re looking to diversify your business portfolio or accelerate your company’s expansion, these investments merit serious consideration.

Understanding High-Risk Investments in Nigeria

The Nigerian investment system presents unique opportunities and challenges for small businesses seeking high-risk, high-reward ventures. Understanding the economic context, risk factors, and potential returns is very important before committing your capital to these investments. With proper knowledge and strategic planning, small businesses can navigate this terrain effectively while managing their exposure to potential losses.

Let’s take a deep dive into the seven areas of investments for small businesses in Nigeria.

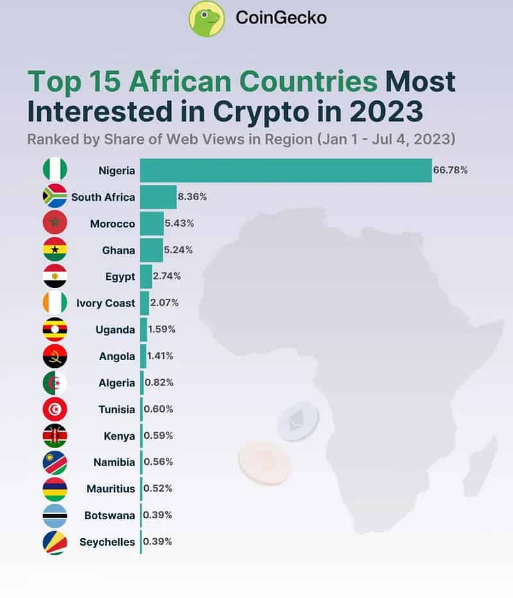

1. Cryptocurrency Investment Opportunities

When you invest in cryptocurrencies, you’re entering a world where your ₦500,000 could double overnight—or vanish completely. Your strategy matters enormously. You’ll want to start with established coins like Bitcoin and Ethereum before exploring Nigerian-focused projects.

Blockchain Business Applications

Most businesses can leverage blockchain beyond just trading. The use of stablecoins such as USDT, USDC to protect against naira fluctuations when paying international suppliers have become very significant over the years.

When investing in the crypto space, consider limiting cryptocurrency to just 10% of your investment portfolio. This boundary protects your business during inevitable market downturns while still allowing you to benefit when values surge.

The Nigerian blockchain ecosystem offers various opportunities for small businesses. You could invest in local startups solving payment problems, potentially seeing returns exceeding 300% within 18 months.

Regulatory uncertainty remains tricky, but you can navigate this aspect by working with reputable exchanges that emphasize compliance. Like all high-risk investments, the key is balancing potential returns against your business’s risk tolerance.

Your journey into cryptocurrency might feel daunting at first, but starting small and learning continuously could position your Nigerian business advantageously in 2025’s evolving financial setting.

2. NFTs and Digital Assets

NFT Market Investment Opportunities

Have you considered adding NFTs to your portfolio of high-risk investments? Nigerian small businesses might benefit from this digital frontier that’s still largely untapped in the local market.

When you create digital assets as NFTs, you’re essentially minting unique digital items that can be bought, sold, and traded. Your business could generate additional revenue streams through content creation and tokenizing original content, artwork, or branded digital collectibles.

Many Nigerian entrepreneurs with several growing investments still don’t realize that the NFT ecosystem in Africa is growing rapidly. You don’t need to be a tech wizard to participate—several user-friendly marketplaces are accessible to Nigerian businesses, with relatively low barriers to entry.

Metaverse and Virtual Real Estate

Businesses could also explore virtual land ownership as one of the high risk investments available. Think of it as buying property, but in digital worlds where people increasingly spend their time and money.

When you purchase virtual real estate, you’re betting on the future of digital interaction. Nigerian businesses could establish a presence in metaverse platforms where customers can experience products or services using CRM in innovative ways.

Virtual storefronts might seem far-fetched, but they’re becoming legitimate high-risk investments that forward-thinking Nigerian businesses are exploring. Your competitors may already be staking claims in these digital territories.

The long-term prospects of metaverse investments depend heavily on adoption rates. Your investment strategy should account for the experimental nature of these digital assets—they could multiply in value or struggle to find practical applications.

Your journey into NFTs and digital assets should start small. Consider allocating a modest portion of your investment capital to explore this space while the entry costs remain relatively affordable for Nigerian entrepreneurs.

Bear in mind that the regulatory framework around NFTs in Nigeria remains underdeveloped. You’ll want to maintain proper documentation of all transactions and be prepared for evolving compliance requirements as the government catches up with these new high risk investments.

3. Agricultural Commodities Investment Opportunities Trading

Another area to look at when it comes to high risk investments for small businesses in Nigeria that might be beneficial is trading cocoa, cashew, and palm oil products which is where Nigeria holds competitive advantages globally.

When you enter agricultural commodity trading, you’re participating in markets with seasonal price swings that create profit opportunities. Your timing can make all the difference, especially with cocoa prices fluctuating up to 40% annually depending on global supply conditions.

Many Nigerian entrepreneurs overlook the export potential in these markets. You could position your business to capitalize on international demand while hedging against local currency instability.

Your success in agricultural commodities depends on recognizing predictable patterns. The cashew harvesting season from February to June creates price dips you can exploit. Your investment strategy should account for these cyclical opportunities when planning your capital allocation.

Export Strategies for Small Businesses

Small businesses don’t need enormous capital to participate. You can start by pooling resources with other entrepreneurs to meet minimum export quantities for cocoa or palm oil.

Agricultural high-risk investments require specific protection strategies. Consider using storage facilities with climate control to preserve quality during price downturns. Your patience during market fluctuations often determines profitability in this sector.

International commodity exchanges are increasingly accessible to Nigerian investors. Your business could participate in these markets through licensed brokers who provide access to global trading platforms where agricultural futures and derivatives are traded.

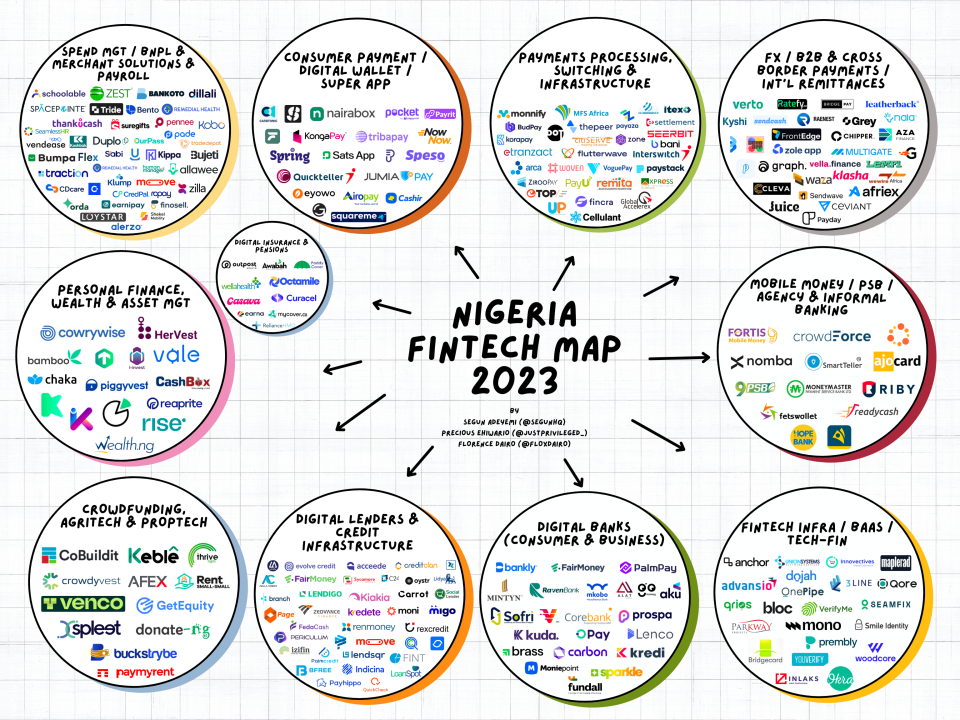

4. Fintech Startup High Risk Investments

Investments in financial technology startups could represent one of the most promising high-risk investments available in the Nigerian market today.

The fintech revolution is transforming how Nigerians bank, save and transfer money. Strategic investment in this sector could generate substantial returns as digital financial services continue expanding across the country.

When you back early-stage fintech ventures, you’re betting on innovation in a market where traditional banking has left millions underserved. Your investment helps bridge this gap while positioning your portfolio for potential explosive growth.

In searching for valuable fintech high-risk investments your focus should be on companies solving real Nigerian problems. Look for startups addressing payment friction, cross-border transfers, or micro-lending platforms that serve the unbanked population.

Structuring Your Fintech Portfolio

The most reliable approach to high-risk investments in the fintech world should include diversification across different segments. I’ve found success by spreading my capital across payment processors, lending platforms, and wealth apps instead of focusing on one.

Many Nigerian entrepreneurs fail to plan their exit before investing in fintech startups. I made this mistake with my early investments and had capital locked up for years. Your investment strategy should include realistic timelines for liquidity, understanding that your money might be inaccessible for 5-7 years before yielding returns.

Note that fintech investments often require follow-on funding rounds. You might need additional capital to maintain your ownership percentage when the company grows and raises more money, so keep reserves available for promising performers in your portfolio.

5. Transportation and Logistics Ventures Investment Opportunities

Your capital could see growth here, especially as e-commerce and urban mobility demands continue to rise across Nigerian cities..

I jumped into transportation high risk investments back in 2022, and despite some early setbacks, it’s become one of the more rewarding segments in my portfolio. Your timing might be even better in 2025, with fuel subsidy adjustments creating new market dynamics.

When you invest in transportation and logistics, you’re addressing a fundamental need in Nigeria’s economy. Your funding helps solve real infrastructure challenges while potentially generating substantial returns in a sector with everyday relevance.

Have you calculated the true maintenance costs for Nigerian roads? I underestimated these expenses when structuring my first transportation investment. Your financial projections should account for vehicle replacement parts costing 30-40% more than global averages due to import challenges.

Managing Security and Operational Risks

Also, many transportation ventures fail because they underestimate security challenges. I lost two vehicles before implementing proper tracking systems. Your risk management plan should include comprehensive insurance, driver verification systems, and real-time vehicle monitoring to protect your high-risk investments in this sector.

Lastly, successful transportation ventures require hands-on management, especially in the early stages. Your investment might need more active oversight than other opportunities, but the direct cash flow can make this sector particularly rewarding for involved investors.

6. Real Estate Development Projects

I once put nearly all my investment funds into a small apartment complex in Lagos, and the lessons from that experience were invaluable. Your approach to real estate investments should be strategic, especially given the unique challenges of the Nigerian property market.

When you invest in real estate development, you’re making a bet on Nigeria’s growing urbanization and middle class. Your timing and location selection can dramatically impact returns, with some areas seeing property values double within 3-5 years while others stagnate.

Identifying Growth Corridors

Your success in real estate high risk investments often depends on spotting emerging neighborhoods before prices surge. I’ve found that areas getting new infrastructure like roads or shopping centers typically see property values climb 15-25% faster than city averages.

Watching construction costs skyrocket by 35% during a six-month build due to cement and steel price fluctuations can be a real pain in the neck especially for people investing in real estate. Financial projections should include substantial buffers for these unpredictable expenses.

Alternative Funding Structures

Your approach to financing real estate developments might include joint ventures with landowners or construction partners. I’ve successfully completed projects where I provided funding while partners contributed land or technical expertise, reducing my capital requirements while maintaining good returns on my high-risk investments.

Remember that real estate ties up your capital longer than many other investment options especially for Nigerians. Your liquidity needs should be carefully considered before committing to property development, as converting these assets to cash often takes significantly more time than anticipated, even in hot markets.

7. Technology and Digital Services

Technology and digital services represent a compelling yet high risk investment sector that continues to reshape global economies. Emerging tech companies often promise groundbreaking innovation but carry significant volatility compared to established players. Investors pursuing high risk investments opportunities in this space should carefully evaluate factors like market disruption potential, scalability, and competitive advantages.

Balancing Innovation and Investment Opportunities

Cloud computing, artificial intelligence, blockchain solutions, and cybersecurity firms frequently attract substantial venture capital despite their uncertain trajectories. The digital services settings’ rapid evolution creates both opportunities and pitfalls for those seeking substantial returns on high risk investments.

Due diligence becomes particularly vital when allocating capital to early-stage technology ventures. While unicorn success stories fuel enthusiasm, many tech startups ultimately fail to deliver projected growth. Diversification strategies can help mitigate the concentrated risks inherent in technology-focused portfolios.

For those with appropriate risk tolerance, the technology sector continues to offer potential outsized returns that traditional blue-chip investments rarely match.

Conclusion

While high-risk investments can significantly accelerate wealth creation for small businesses in Nigeria, success depends on calculated strategy rather than chance. The seven investment categories explored—from cryptocurrency and NFTs to real estate and technology ventures—each offer distinct advantages and challenges in Nigeria’s unique economic landscape. The most successful Nigerian businesses approaching these opportunities employ diversification, thorough research, and risk management frameworks tailored to local market conditions.

As Nigeria’s economy continues evolving through 2025, businesses that strategically allocate portions of their capital to these high-potential sectors, while maintaining adequate operational liquidity, position themselves for exponential growth. By balancing ambition with prudence, small businesses can harness these high-risk investments to achieve remarkable financial outcomes in Nigeria’s dynamic marketplace.

FAQ’s

Financial experts typically recommend that small businesses in Nigeria allocate no more than 10-20% of their investable assets to high-risk ventures. The exact percentage depends on several factors: your business’s financial stability, cash flow predictability, existing obligations, growth stage, and overall risk tolerance.

High-risk investments in Nigeria carry various tax considerations depending on the investment type. Cryptocurrency gains may fall under capital gains tax, though regulations remain evolving. Real estate investments involve property taxes, capital gains tax on property sales, and possible rental income taxes. Business venture investments may be subject to corporate income tax on profits.

To verify investment legitimacy in Nigeria: first, check if the investment vehicle or company is registered with appropriate regulatory bodies like the SEC, CAC, or CBN depending on the investment type. Research the company’s history, leadership team, and track record – legitimate operations should have verifiable physical addresses and proper documentation.

Nigeria’s regulatory stance on cryptocurrencies has evolved significantly. While the Central Bank of Nigeria (CBN) previously restricted banks from facilitating cryptocurrency transactions, the government has been developing a more structured approach recognizing digital assets. Nigerian businesses investing in cryptocurrencies must now consider the Securities and Exchange Commission’s (SEC) classification of digital assets as securities.