For most beginners, taking that first step into investing feels like stepping into unknown territory without a map. Yet, the difference between financial security and ongoing money stress often lies in understanding how to make your money work for you. Investing for beginners starts with learning the basics and building confidence over time..

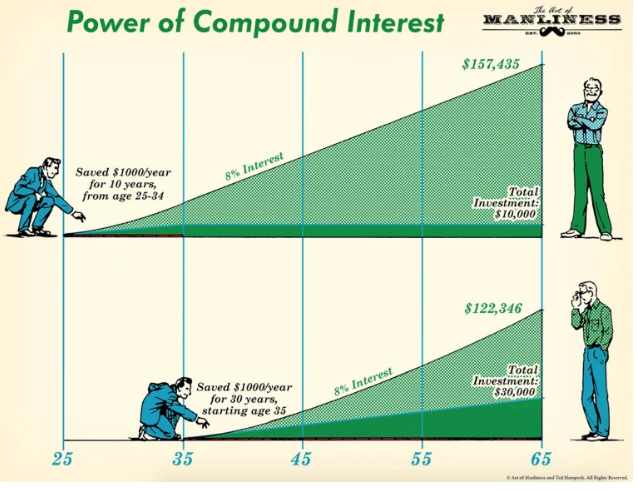

In today’s economy, simply saving money isn’t enough—inflation steadily erodes the purchasing power of money sitting idle in low-interest accounts. According to recent data, individuals who begin investing early in their 20’s can accumulate up to 3x more wealth than those who delay.

This comprehensive guide cuts through the complexity that keeps many would-be investors on the sidelines. Whether you have $100 or $10,000 to start with, we’ll walk you through proven, accessible strategies that real people use to build wealth gradually.

Understanding Investment Fundamentals

The journey into investing begins with grasping the essential concepts that form the foundation of wealth building. Investing isn’t about getting rich quickly—it’s about understanding how different investment vehicles work together to grow your wealth over time while managing risk effectively.

Familiarizing yourself with these fundamentals creates the confidence needed to make informed decisions as you begin your investment journey.

Setting Your Investment Portfolio for Beginners Foundation

Financial Preparation Before Investing

Many people make the same mistake when they first approach investing for beginners – jumping straight into buying assets without having their financial house in order first. You need a proper foundation before putting your hard-earned money into the market.

Emergency Fund First

Before you start your investing for beginners journey, you should establish a solid emergency fund. Aim to set aside enough to cover 3-6 months of essential expenses. This financial cushion protects your investment portfolio for beginners when unexpected costs arise – like when your refrigerator decides to quit or your car needs major repairs. Without this safety net, you might be forced to sell your investments at the worst possible time.

Tackle High-Interest Debt & Understanding Cash Flow

Looking to optimize your investment portfolio for beginners? Pay down that high-interest debt first. Credit cards charging 18% or more essentially guarantee a negative return on any investment you might make elsewhere. Eliminating these financial drains should be a priority before seriously pursuing investing for beginners strategies.

You can’t know how much to invest until you know where your money goes each month. Take time to review your spending patterns and identify areas where you might free up additional funds for investing for beginners.

Many people discover they’re spending surprising amounts on subscriptions, dining out, or impulse purchases that could instead be directed toward building wealth.

Define Clear Financial Goals

Your investment approach should align with specific financial targets and timeframes. When establishing your investment portfolio for beginners, clarify whether you’re saving for a short-term goal (under 3 years), medium-term goal (3-10 years), or long-term goal (10+ years). This clarity helps determine appropriate risk levels and investment vehicles. Short-term goals typically require more conservative investments, while long-term goals can withstand more market volatility.

Getting these financial fundamentals right makes your investing for beginners journey much smoother and more successful. By building this solid foundation first, you position yourself to create an investment portfolio for beginners that has real growth potential without putting your financial stability at risk.

Investment Portfolio for Beginners

Stock Market Basics

When you’re new to the world of investing for beginners, the stock market can seem incredibly intimidating. All those ticker symbols, charts, and financial terms might make you want to run the other way. But understanding stocks is worth the effort for anyone serious about building wealth.

What Are Stocks?

Stocks represent actual ownership in real companies. When you buy shares, you’re not just getting a ticker symbol – you’re becoming a partial owner of that business. This fundamental concept forms the foundation of any investment portfolio for beginners. Many newcomers don’t fully grasp that behind every stock purchase is a company with employees, products, and either profits or losses.

Understanding Market Indices

You’ve probably heard people mention the S&P 500 or the Dow Jones, but what do these actually mean? These indices track groups of stocks to give a snapshot of market performance. They’re like the temperature gauge for investing for beginners to monitor overall market health. The S&P 500, for example, includes 500 large American companies and is often used as a benchmark for investment performance.

Growth vs. Value Approaches

As you build your investment portfolio for beginners, you’ll encounter two main stock investing philosophies. Growth stocks belong to companies reinvesting profits for expansion, while value stocks are established businesses trading below what analysts consider their true worth. Neither approach is inherently superior – many successful investing for beginners strategies incorporate both types in different proportions.

The Power of Dividends

Some companies share profits directly with shareholders through dividend payments. These regular cash distributions can provide steady income and significantly boost long-term returns when reinvested. For those exploring investing for beginners options, dividend-paying stocks offer a nice balance of potential growth plus tangible, regular returns. Over time, dividends can grow substantially, creating an increasingly valuable income stream from your investment portfolio for beginners.

Bonds and Fixed Income

While stocks get all the excitement, bonds play a significant role in any well-rounded investment portfolio for beginners. Think of bonds as loans you’re making to organizations that promise to pay you back with interest.

When you buy a bond, you’re essentially lending money to the issuer for a specific period. During that time, you typically receive regular interest payments, and when the bond matures, you get your original investment back. This predictability makes bonds an important component of investing for beginners who need some stability to balance riskier investments.

Types of Bonds

Your options range from ultra-safe government bonds to potentially riskier corporate offerings.

U.S. Treasury bonds represent loans to the federal government and are considered among the safest investments available.

Municipal bonds fund local projects and often offer tax advantages.

Corporate bonds typically pay higher interest rates but come with more risk. Each serves different purposes in an investment portfolio for beginners.

Interest Rate Effects

What confuses new investors is when interest rates rise, existing bond values fall. This inverse relationship catches many investing for beginners enthusiasts off guard. If you buy a bond paying 3% interest and rates later jump to 5%, your bond becomes less attractive compared to new offerings, reducing its market value if you need to sell before maturity.

Agencies like Moody’s and S&P rate bonds based on the issuer’s financial stability. Higher-rated bonds (AAA, AA) offer greater security but lower yields, while lower-rated bonds pay more interest to compensate for increased risk. Understanding these ratings helps in creating an appropriate investment portfolio for beginners based on your personal risk tolerance.

Mutual Funds and ETFs

For most people starting their investing for beginners journey, individual stocks and bonds aren’t the best first step. Mutual funds and ETFs offer an easier way to get started with professional management and instant diversification.

Mutual Fund Basics

These investment vehicles pool money from many investors to purchase a diversified collection of securities. Professional managers make buying and selling decisions based on the fund’s stated objectives. For those new to investing for beginners concepts, mutual funds offer expertise and diversification that would be difficult to achieve on your own when starting with limited capital.

By spreading investments across dozens or hundreds of securities, funds immediately reduce the risk that comes from having too few investments. If one company in the fund performs poorly, others might balance it out. This built-in safety feature makes funds particularly attractive for those creating their first investment portfolio for beginners.

Active vs. Passive Management investment portfolio for beginners

Actively managed funds employ professionals who try to beat market averages through research and strategic trading. Index funds, while being passive simply mirror existing market indices like the S&P 500. The investing for beginners community increasingly favors index funds because they typically charge lower fees and, surprisingly, often outperform their actively managed counterparts over longer periods.

What are the Fee Structures

The costs associated with funds can significantly impact your long-term returns. Expense ratios represent the percentage of your investment that goes toward management fees annually. Even small differences add up dramatically over time.

A 1% difference in fees could mean hundreds of thousands of dollars less in your investment portfolio for beginners over several decades. This makes low-cost index funds particularly attractive for long-term investing for beginners strategies.

The beauty of these investment options is that they provide a flexible foundation for beginners. You can start simply with just one or two broad market funds and gradually add more specialized investments as your knowledge and confidence grow.

Many successful investors maintain these fund-based strategies throughout their investing journey, finding the simplicity and diversification benefits hard to beat.

Starting Your Investment Journey

Setting Up Your First Investing For Beginners Account

Getting started with actual investing requires choosing where your money will live. This decision can feel overwhelming with so many options available, but breaking down the choices makes investing for beginners much more approachable.

Investing for Beginners Account Types

You’ll encounter several options when setting up your first investment portfolio for beginners. Traditional brokerage accounts offer flexibility but lack tax advantages. Robo-advisors provide automated management with minimal involvement from you.

Retirement accounts like 401(k)s and IRAs offer significant tax benefits but come with withdrawal restrictions. Each serves different purposes in your investing for beginners strategy, and many investors eventually use a combination.

Setting up an investment account has become remarkably simple. Most platforms let you complete the entire process online in under 30 minutes. You’ll need basic personal information, your social security number, and banking details to transfer funds.

Many investing for beginners platforms now offer fractional shares, meaning you can start with whatever amount feels comfortable – even just $25 or $50 per month.

Tax-Advantaged Options and Micro-Investing Platforms

Don’t overlook accounts that offer tax benefits when building your investment portfolio for beginners. Employer-sponsored 401(k) plans often include matching contributions – essentially free money.

Traditional IRAs offer tax deductions now but tax withdrawals later. Roth IRAs require after-tax contributions but provide tax-free growth and withdrawals. These tax advantages can dramatically boost your funds long-term while investing for beginners when compared to standard brokerage accounts.

For those with limited capital, specialized apps make investing for beginners more accessible than ever. Platforms like Acorns, Stash, and Robinhood allow you to start with very small amounts and gradually build your investment portfolio as a beginner. Some even round up your everyday purchases and invest in the spare change. While these platforms won’t make you wealthy overnight, they provide an educational starting point with minimal financial commitment.

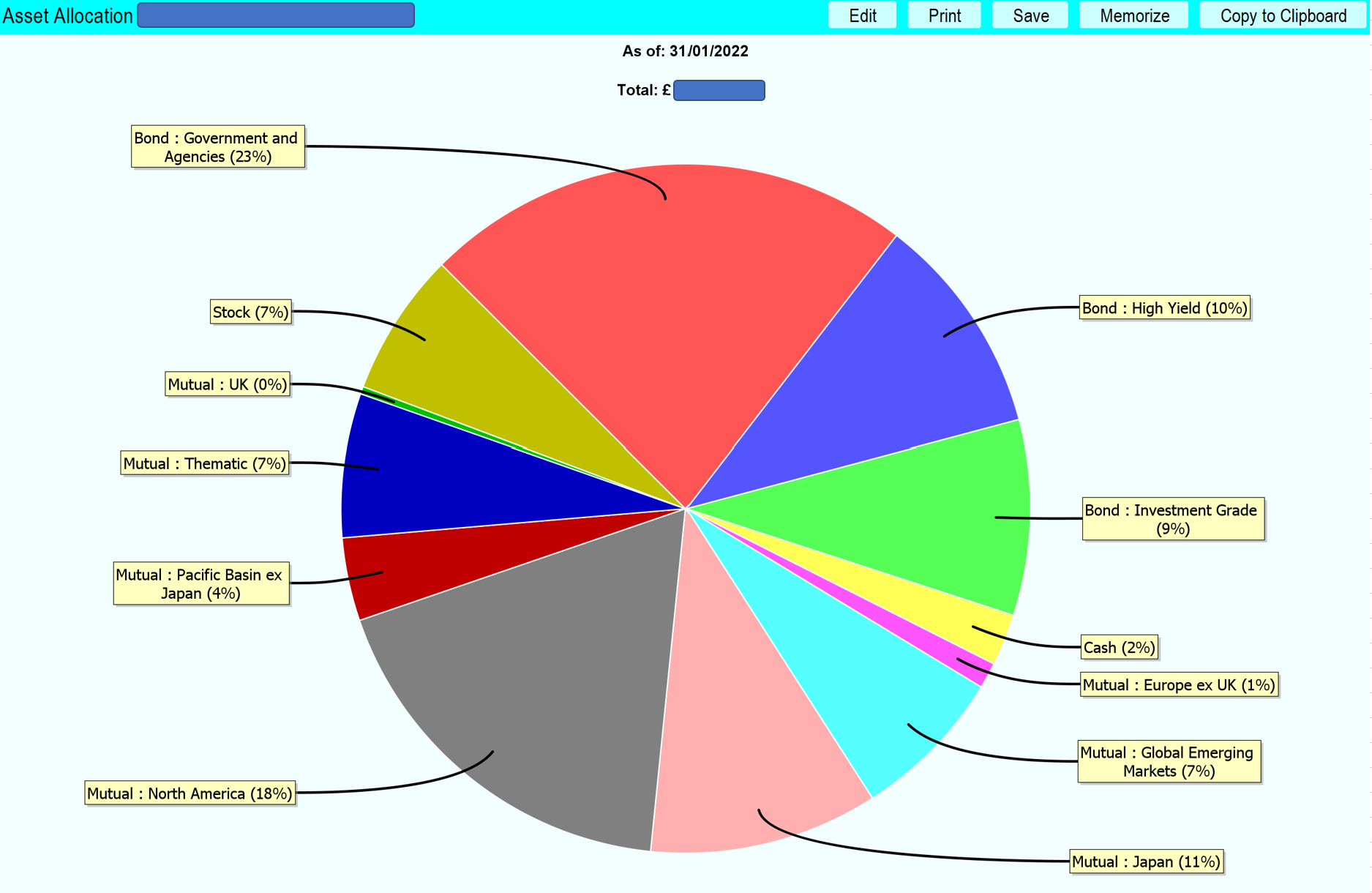

Creating a Diversified Portfolio

Once your account is established, the next challenge in investing for beginners is deciding what to actually buy. Diversification – spreading your investments across different types of assets forms the cornerstone of smart investing.

Asset Allocation Fundamentals

How you divide your money among stocks, bonds, and other investments dramatically impacts both your potential returns and risk exposure. More aggressive investment portfolios for beginners might allocate 80-90% to stocks, while conservative portfolios might reverse that ratio. Your age, goals, and risk tolerance should guide these decisions when implementing investing for beginners strategies.

Model Portfolio Examples

You don’t need to reinvent the wheel when starting your investing for beginners process. Many financial institutions offer model portfolios based on age and risk tolerance.

A common starting point for younger investors might be 70-80% in broad stock market funds, 10-20% in bond funds, and perhaps 5-10% in alternative investments. These templates provide useful frameworks for creating your own investment portfolio for beginners.

Investing for Beginners Rebalancing Strategies

Over time, some investments will grow faster than others, shifting your asset allocation away from your target. Restoring your original mix through periodic rebalancing is vital for managing risk in your investment portfolio for beginners.

Most investing for beginners guides recommend reviewing your allocation annually or when major market movements create significant imbalances. Rebalancing essentially enforces the “buy low, sell high” principle by trimming investments that have grown and adding to those that haven’t.

Building a properly diversified portfolio doesn’t require dozens of holdings or complex strategies. Many successful investors achieve excellent diversification with just a handful of broad-market index funds.

The key is ensuring these selections work together to provide comprehensive market exposure while aligning with your specific investing for beginners goals and risk tolerance.

Investment Portfolio for Beginners Strategies

Dollar-Cost Averaging investing for beginners

Dollar-cost averaging stands as one of the smartest approaches to investing for beginners. This strategy involves investing fixed amounts at regular intervals, regardless of market conditions.

When you invest the same amount regularly – perhaps $100 monthly – you naturally buy more shares when prices are low and fewer when prices are high. This systematic approach removes the emotional guesswork from timing the market and provides a disciplined framework for building your investment portfolio for beginners.

Nobody can consistently predict market movements. Dollar-cost averaging acknowledges this reality and turns market volatility into an advantage.

For those just starting their investing for beginners journey, this strategy reduces the pressure of making perfect entry-point decisions.

Long-Term Investment Thinking

The most successful investors share one key trait: patience. Adopting long-term thinking dramatically improves your chances of investing success.

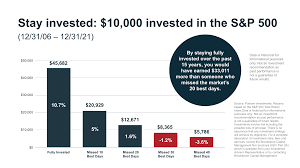

Patience Over Timing

Market history repeatedly shows that time in the market outperforms timing the market. For those building an investment portfolio for beginners, this means focusing on consistent participation rather than perfect entry and exit points. The longer your investing timeframe, the more likely you are to experience positive returns.

Daily financial news creates an illusion that constant action is necessary. In reality, most market movements represent meaningless noise for long-term investors. Successful investing for beginners strategies typically involves less frequent monitoring and trading than most people assume.

Fear and greed drive poor investment decisions. Studies show investor returns typically lag behind the very funds they invest in because of emotional buying and selling at precisely the wrong times.

Understanding these psychological pitfalls helps you maintain discipline in your investment portfolio for beginners.

Common Mistakes investing for Beginners need to Avoid

Your biggest investment enemy often isn’t the market but your own emotions. Understanding psychological pitfalls helps you avoid costly mistakes when investing as a beginner.

Fear and Greed Dangers

These powerful emotions drive most investment missteps. Fear pushes you to sell during downturns, locking in losses. Greed tempts you to chase hot investments after they’ve already surged. Both undermine long-term performance in your investment portfolio for beginners.

Avoiding Panic Selling

Market corrections and bear markets are normal parts of investing. When your stocks drop 20%, your instinct screams “sell!” However historical data shows that investing for beginners works best when you resist this urge. Markets have always recovered eventually, making patience your most valuable asset.

Humans naturally overweight recent events when making predictions. After several good years, investors expect continued gains. After downturns, they predict further decline. This psychological tendency leads to poor timing decisions that damage investment portfolio for beginners performance.

Written investment plans help combat emotional reactions. During calm periods, document your strategy and commit to sticking with it. Many successful investing for beginners approaches include automatic rebalancing to enforce discipline when emotions run high.

Technical Missteps When Creating investment portfolio for beginners

Beyond emotional errors, several technical mistakes commonly derail beginning investors. One of many mistakes most beginners make is:

Diversification Pitfalls

While diversification matters, owning too many similar investments creates unnecessary complexity without additional protection. Some new investors own dozens of overlapping funds in their investment portfolio for beginners, creating higher costs without better returns.

Last year’s winning investments often become next year’s underperformers. When you constantly shift your investing for beginners strategy toward recent winners, you typically buy high and sell low – exactly opposite of successful investing.

Getting Started: Your Steps to Financial Freedom

First Week Action Plan

Turning investment knowledge into actual action separates successful investors from perpetual planners. Here’s how to make investing for beginners a reality rather than just an intention.

1. Financial Assessment Fundamentals

Begin by taking stock of your complete financial picture. Calculate your net worth by listing all assets and debts. Review your monthly cash flow to determine how much you can consistently invest. This financial clarity provides the foundation for any sustainable investment portfolio for beginners.

2. Platform Selection Strategy

Research and choose an investment platform that matches your needs. Low-cost brokerages like Vanguard, Fidelity, and Charles Schwab make investing for beginners accessible with minimal fees. Robo-advisors like Betterment or Wealthfront provide automated management for slightly higher costs.

Consider factors like minimum investment requirements, available investment options, and user interface before deciding.

3. Automation Implementation

Set up automatic transfers from your checking account to your investment account. Even small amounts – $25 or $50 weekly – add up significantly over time. This automation removes willpower from the equation and ensures consistent progress in building your investment portfolio for beginners regardless of market conditions or emotional reactions.

4. Starter Allocation Setup

Begin with a simple allocation appropriate for your situation. For many beginning investors, a target-date fund offers an all-in-one solution that automatically adjusts as you approach your goal date.

Alternatively, a basic investing for beginners portfolio might include just two funds: a total stock market index fund and a total bond market index fund, proportioned according to your risk tolerance.

Ways to Measure Progress in Investing for Beginners

Once your investment journey begins, tracking progress appropriately keeps you motivated and on track.

1. Performance Tracking Principles

Learn to measure investment performance meaningfully. Focus on progress toward your financial goals rather than beating arbitrary benchmarks. Understand that investing for beginners requires patience – significant results typically take years rather than weeks or months to materialize.

For long-term investors, total return (price appreciation plus dividends/interest) matters more than price movement alone. Your investment portfolio for beginners should be evaluated on appropriate timeframes – at least 3-5 years for stock investments – rather than daily or monthly fluctuations.

2. Strategy Adjustment Approach

As you gain knowledge and experience, gradually refine your investment approach. This might involve increasing contributions, fine-tuning your asset allocation, or adding specialized investments. However, major strategy shifts in investing for beginners should be based on life changes or goal adjustments, not market predictions.

Conclusion

Investing might seem complex at first glance, but it becomes increasingly manageable as you build knowledge and experience. The most important step is simply to begin. By starting with a solid understanding of investment fundamentals, assessing your personal financial situation, and implementing proven strategies like diversification and dollar-cost averaging, you’re already ahead of many who remain on the sidelines.

Always bear in mind, that investing is a marathon, not a sprint—patience, consistency, and continuous learning will serve you better than seeking quick returns. Every financial journey begins with small steps, and even modest investments today can grow significantly over time thanks to compound returns. Your future self will thank you for having the foresight to begin building wealth today.

FAQ’s

You can start investing with as little as $1-5 using micro-investing apps like Acorns or Stash. Many brokerages now offer fractional shares, allowing you to invest in expensive stocks with small amounts.

While the stock market involves risk, the level of risk depends on your investment choices and time horizon. For beginners, broad-based index funds offer lower risk through diversification while still providing growth potential.

No, you don’t necessarily need a financial advisor to begin investing, especially with today’s user-friendly platforms and educational resources. Robo-advisors offer algorithm-based portfolio management at lower costs than traditional advisors.

Choose an investment platform based on your specific needs by comparing fees (trading commissions, account fees, expense ratios), available investment options, educational resources, user interface, customer service, and account minimums.