Tired of wondering where your money disappears each week? I feel your pain! A study revealed that 50% of US citizens are financially literate but with a 2% drop over the past two years. A weekly budget planner offers a powerful solution to this common financial blind spot.

Unlike monthly budgeting, which can feel overwhelming and abstract, weekly planning and saving create manageable chunks that align perfectly with how most of us receive and spend our money.

Whether you’re trying to pay down debt, save for a vacation, or simply gain control over your day-to-day expenses, the right weekly budget planner can be the difference between financial stress and financial success. The good news is there’s never been a better selection of templates, apps, and methods to choose from!

Weekly Budget Planner Options to Transform Your Financial Life

A weekly budget planner serves as your personal financial command center, helping you make informed decisions about your money in real time. In addition, it helps keep tracking expenses every week rather than monthly, so you can catch overspending before it derails your financial goals.

The key is finding a system that matches your lifestyle, preferences, and specific financial needs. Each of the options below offers unique advantages that might make it the perfect fit for your situation.

Let’s explore the different kinds of weekly budget planners necessary for your financial goals.

1. Digital Spreadsheet Templates

Every financial journey starts with understanding where your money goes, and a weekly budget planner can be your most powerful ally in this quest. When I first started tracking my expenses, spreadsheets were like a financial revelation – transforming chaotic spending into crystal-clear insights.

Why Digital Spreadsheets Rule for Weekly Budget Planning

Digital spreadsheets aren’t just cells and formulas; they’re dynamic financial maps that guide your money management journey. A well-crafted weekly budget planner spreadsheet does more than track expenses – it tells a story about your financial habits.

Google Sheets and Excel have revolutionized how we approach weekly budget tracking. These platforms offer more than just number-crunching; they provide real-time collaboration, automatic calculations, and the flexibility to customize your financial tracking precisely how you need it.

Crafting Your Perfect Weekly Budget Planner Template

Creating an effective weekly budget planner requires thinking beyond basic addition and subtraction. You’ll want templates that not only track expenses but also predict potential financial pitfalls. Color coding became my secret weapon – red sections instantly highlight overspending, while green zones celebrate successful saving weeks.

Pro tip: Don’t just input numbers blindly. Take time to categorize your expenses meticulously. Transportation, groceries, entertainment – break them down so precisely that you can spot even the tiniest financial leaks.

Automation: The Secret Sauce of Digital Budget Tracking

Modern spreadsheet templates can practically manage themselves. However, a weekly budget planner that automatically calculates remaining funds, warns you about approaching spending limits, and generates visual representations of your financial health is what makes the whole difference. It’s like having a financial advisor working 24/7 in your digital workspace.

Some advanced templates even integrate predictive analysis, helping you forecast potential savings or identify recurring expenses you might want to trim. These aren’t just spreadsheets; they’re financial crystal balls.

Making Your Weekly Budget Planner Work for You

The key to a successful weekly budget planner isn’t perfection – it’s consistency. Start simple. Maybe you’ll track just three categories in your first week. Then gradually expand. Each week, you’ll get better at understanding your spending patterns.

Remember, a digital spreadsheet is a tool, not a magic wand. It won’t automatically save money for you, but it’ll shine a spotlight on where your hard-earned cash is really going. And sometimes, that awareness is the first step toward financial transformation.

Methods to apply for Your Weekly Budget Planner:

- Use formulas to automatically calculate totals

- Create separate sheets for different expense categories

- Set up conditional formatting to highlight spending trends

- Include a weekly review section to reflect on your financial choices

Your weekly budget planner isn’t just about restricting spending – it’s about empowering yourself to make informed financial decisions. One spreadsheet at a time, you’re building a roadmap to financial freedom.

2. Budgeting Apps With Weekly Features

Technology has transformed how we manage money, and weekly budget planner apps are the silent heroes of personal finance. Gone are the days of manual tracking and endless spreadsheet calculations. Now, powerful apps sit right in your pocket, ready to decode your spending habits at a moment’s notice.

App Ecosystem: Your Digital Weekly Budget Companion

My financial journey wasn’t always smooth sailing. I remember the days of misplaced receipts and surprise overdraft fees. Then, mobile budgeting apps entered my life like a financial superhero, offering real-time insights and automated tracking that changed everything.

YNAB (You Need A Budget) became my first digital budget ally. Its mobile receipt capture felt like magic – snap a picture, and boom, your expense is logged. The app’s weekly spending breakdown transformed abstract numbers into clear financial digits, helping me understand where every dollar wandered.

Smart Features That Make Weekly Budget Planning Effortless

Mint’s weekly spending alerts are like having a financial guardian angel. How does it feel getting a gentle nudge when you’re creeping close to your entertainment budget or dining out too much? These intelligent notifications aren’t just alerts; they’re personalized financial coaching.

EveryDollar takes a different approach, breaking down your weekly income into precise financial stability and allocations. It’s not just about tracking expenses; it’s about giving purpose to every single dollar. The app practically turns budgeting into a strategic game where you’re the financial mastermind.

Apps That Prevent Financial Missteps

PocketGuard’s real-time spending limit features are a game-changer for impulse spenders. Before making a purchase, the app shows exactly how much money remains in your weekly budget. It’s like having a financially responsible friend whispering, “Are you sure about this?”

Goodbudget’s digital envelope system brings an old-school budgeting technique into the 21st century. You allocate weekly cash allowances to different categories, creating digital envelopes that prevent overspending. It’s budgeting with training wheels, ensuring you stay on financial track.

Turning Apps into Weekly Budget Planning Superpowers

The magic of these apps isn’t just in their features – it’s in how they transform your relationship with money. They convert complicated financial tracking into bite-sized, manageable insights.

Pro tip: Don’t expect perfection from day one. These apps learn and adapt with you. Start simple, connect your accounts, and let the technology work its magic. Each week, you’ll become more financially aware and confident.

Methods to apply for App-Based Weekly Budget Planning:

- Choose an app that matches your financial personality

- Enable all notification features

- Review your weekly insights regularly

- Don’t be afraid to switch apps if one doesn’t feel right

Your smartphone is no longer just a communication device – it’s a powerful weekly budget planner waiting to revolutionize your financial life.

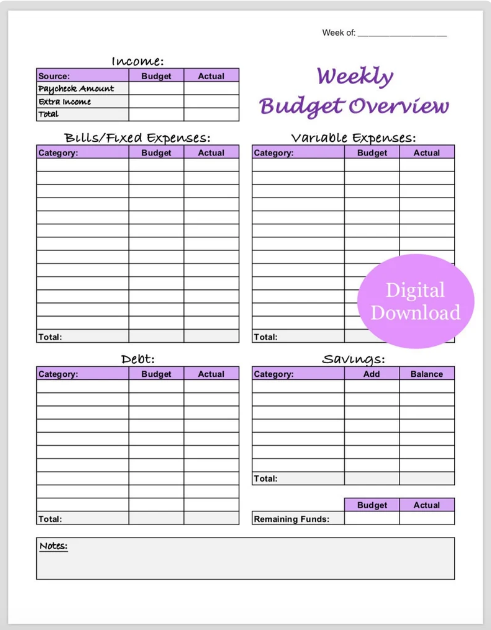

3. Printable Weekly Budget Planner: Bringing Finances to Life on Paper

In our digital age, there’s something profoundly satisfying about a physical weekly budget planner. Pen, paper, and pure financial intention – a combination that connects you more intimately with your money than any app ever could.

The Tactile Power of Printable Budget Tracking

I’ve always been a tech enthusiast, but my journey with weekly budget planning revealed an unexpected truth: sometimes, writing things down creates a deeper mental connection. Printable worksheets aren’t just paper; they’re financial meditation tools.

A well-designed weekly budget planner worksheet is like a financial roadmap. Dedicated spaces for each day’s expenses transform abstract spending into concrete reality. You’re not just recording numbers; you’re creating a narrative of your financial choices.

Integrating bill payment checklists within your weekly spending tracker adds another layer of financial organization. It’s like having a personal assistant who ensures nothing slips through the cracks. Each checkbox becomes a small victory in your financial management journey.

Creative Tracking: Beyond Basic Budgeting

No-spend day challenges boost and turn your money planner into a game of financial strategy. By marking days where you consciously avoid unnecessary expenses, you’re training your financial muscles. It’s not deprivation; it’s empowerment.

Expense category breakdown sheets reveal fascinating patterns. Suddenly, you’re not just tracking money – you’re understanding your spending psychology. That random $15 coffee suddenly looks different when you see it aggregated over a week.

Visualization: Making Weekly Budget Goals Tangible

Weekly savings goal visualizers are psychological powerhouses. Bullet journaling enthusiasts have elevated weekly budget worksheets into an art form. Spending log spreads become beautiful, personalized financial diaries. Each meticulously drawn category and carefully colored tracker is a testament to intentional money management.

Your weekly budget planner doesn’t need to be perfect. Some weeks, you’ll nail every category. In other weeks, you’ll spectacularly miss the mark. The worksheet is a learning tool, not a judgment device.

Methods to apply in your Worksheet:

- Use different colored pens for various expense categories

- Place your worksheet somewhere you’ll see it daily

- Review and reflect at week’s end, not to criticize but to understand

- Celebrate small wins and learning moments

4. Bullet Journal Budget Layouts

Financial tracking doesn’t have to be a mundane spreadsheet exercise. My first encounter with bullet journaling felt like discovering a secret weapon of personal finance. It wasn’t just about tracking expenses; it was about creating a visual narrative of my financial journey. A weekly budget planner suddenly became a canvas of self-discovery.

Designing Your Financial Masterpiece

Having a weekly spending log as part financial tracker and part personal art project could be mind-blowing. Bullet journal spreads break free from traditional budget constraints, offering layouts that are as unique as anything else.

Spending “thermometers” that fill up as you approach weekly limits are visual motivation. Watch as your carefully colored sections rise, providing an immediate, visceral understanding of your financial habits. It’s like a game where you’re both the player and the scorekeeper.

Integrating Habits and Finances

One of the most powerful aspects of a bullet journal weekly budget planner is habit-tracking integration. Just by placing your financial goals alongside other life habits, you create a holistic view of personal growth. That gym membership? Your savings goal? They’re no longer separate – they’re interconnected parts of your life’s design.

Weekly bill trackers with checkboxes become more than just administrative tools. Each completed checkbox is a small victory, a moment of financial discipline celebrated through creative design. You’re not just paying bills; you’re building a visual record of financial responsibility.

The Psychological Power of Visual Tracking

Savings goal progress bars transform abstract financial targets into tangible achievements. As you manually color or fill these bars each week, you’re creating a psychological reward system. The act of tracking becomes as satisfying as the financial goal itself.

Pro tip: Don’t aim for perfection in your bullet journal weekly budget planner. Embrace the messy, human side of financial tracking. Some weeks, your pages might look like a beautiful mess – and that’s perfectly okay.

Methods to apply for Bullet Journal Budget Tracking:

- Choose a consistent color palette for visual coherence

- Create symbols that represent different expense categories

- Include a monthly reflection page to review your financial journey

- Allow space for emotions and thoughts alongside the numbers

5. Weekly Budget Planner Reimagined: The Cash Envelope Revolution

In a world of digital transactions and invisible money, the cash envelope system brings a refreshingly tangible approach to weekly budget planning. It’s budgeting you can touch, feel, and see.

Before digital apps became ubiquitous, my grandmother taught me the power of cash envelopes. Each envelope represented a spending category, creating physical boundaries that digital systems could never replicate. A weekly budget planner wasn’t just numbers – it was a collection of carefully allocated cash packets.

Designing Your Cash Envelope System

Modern cash envelope systems go far beyond simple paper containers. Specialized templates designed for a seven-day spending cycle transform budget tracking into a strategic financial game. Portable envelope wallets are engineering marvels of budget management.

Expense tracking cards inserted into each envelope add another layer of financial mindfulness. Every transaction becomes a deliberate, recorded choice. You’re not just spending money; you’re creating a documented financial narrative.

The psychological impact is profound. When cash is physically limited, spending becomes more intentional. Digital transactions can feel abstract, but pulling cash from a designated envelope makes each expenditure feel real and consequential.

Customization: Making the System Work for You

No two financial journeys are identical, and cash envelope systems understand this. Whether you’re a strict budgeter or someone seeking more flexible tracking, these systems adapt. Weekly budget planners become personalized financial ecosystems.

Pro tip: Start with just three to four categories in your first week. Complexity can be overwhelming. Your goal is creating awareness, not achieving instantaneous perfection.

Methods to apply for the Cash Envelope Weekly Budget:

- Use different colored envelopes for easy categorization

- Set a specific day each week to reset and redistribute cash

- Take photos of your expense tracking cards for digital backup

- Be kind to yourself during the learning process

The cash envelope system proves that sometimes, the oldest financial technologies remain the most powerful. Your weekly budget planner becomes a physical journey of financial understanding.

Conclusion

Finding the right weekly budget planner can revolutionize your relationship with money by bringing clarity, control, and purpose to your spending decisions. Whether you prefer the tangible nature of cash envelopes, the convenience of digital apps, or the creativity of bullet journal layouts, the key is consistency in tracking your expenses and reviewing your progress.

Start with one of the five options we’ve outlined, adapting it to fit your unique financial goals. Remember. Begin with simple tracking, celebrate your progress, and adjust your system as you learn more about your spending habits. With the right weekly budget planner as your financial companion, you’ll be amazed at how quickly you can transform financial chaos into confidence and achieve the goals that matter most to you.

FAQ’s

A weekly budget planner breaks your finances into smaller, more manageable timeframes compared to monthly budgeting. This approach provides more immediate feedback on your spending habits, allowing you to make adjustments before small overspending incidents compound into major budget problems.

Most people spend about 15-20 minutes setting up their weekly budget at the beginning of each week and then 5-10 minutes daily for entering expenses and reviewing balances. Digital apps with receipt scanning or bank integration features can reduce this time significantly.

Yes, you can effectively use a weekly budget planner regardless of your pay schedule. For bi-weekly or monthly income, you’ll need to distribute your income across multiple weeks. Many templates and apps have features specifically designed for this purpose. The process involves dividing your monthly expenses by the number of weeks and allocating that amount weekly.

Effective weekly budget planners typically include both fixed and variable expense categories. Essential categories include groceries, dining out, transportation (gas, public transit, rideshares), entertainment, shopping, household items, and personal care.

Irregular expenses like quarterly insurance premiums, annual subscriptions, or seasonal costs can be managed through “sinking funds” within your weekly budget. Calculate the total annual cost of each irregular expense, divide by 52, and set aside that amount weekly in designated categories.